Challenge Overview

Survival modeling, the statistical prediction of time until a specific event occurs, holds immense value across the financial sector. Its applications are crucial for tasks such as estimating the time until loan repayment or default, and predicting portfolio churn, to provide critical insights for risk management, strategic planning, and customer retention.

In the context of finance, survival analysis involves tracking a group of entities from an index event until a designated outcome event. For instance, the index event could be the origination of a loan, with the outcome event being its repayment or default. Similarly, for a customer portfolio, the index event might be a customer's onboarding, and the outcome event could be churn, i.e., when they cease using services.

Task Description

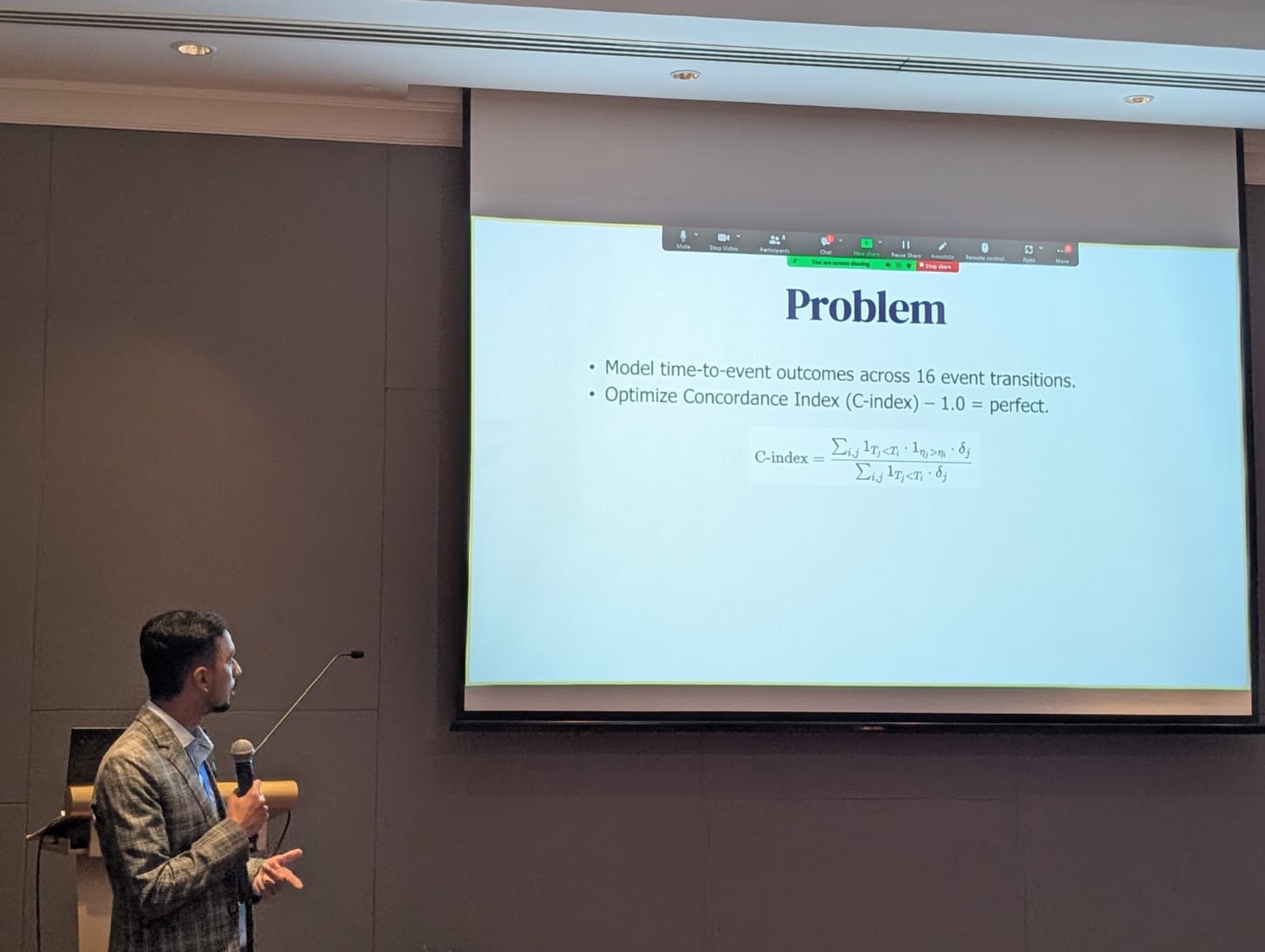

In the FinSurvival Challenge, the primary objective is time-to-event prediction. This means participants will build models to accurately predict how long it takes from an index event (e.g., a loan being issued) until a specific outcome event occurs (e.g., the loan is repaid or liquidated). The primary evaluation metric for this task is the Concordance Index (C-index), where a score of 0.5 indicates random guessing and 1.0 represents perfect prediction.

We expect participants to develop models that can outperform existing benchmarks, particularly the FinSurvival benchmark, by leveraging advanced machine learning and deep learning techniques to capture the complex, non-linear relationships present in real-world DeFi transaction data.

📥 Download Training Data & Starting Kit

Access the complete training dataset and starting kit with sample code to help you develop your solutions.

Download Data & Starting KitDataset

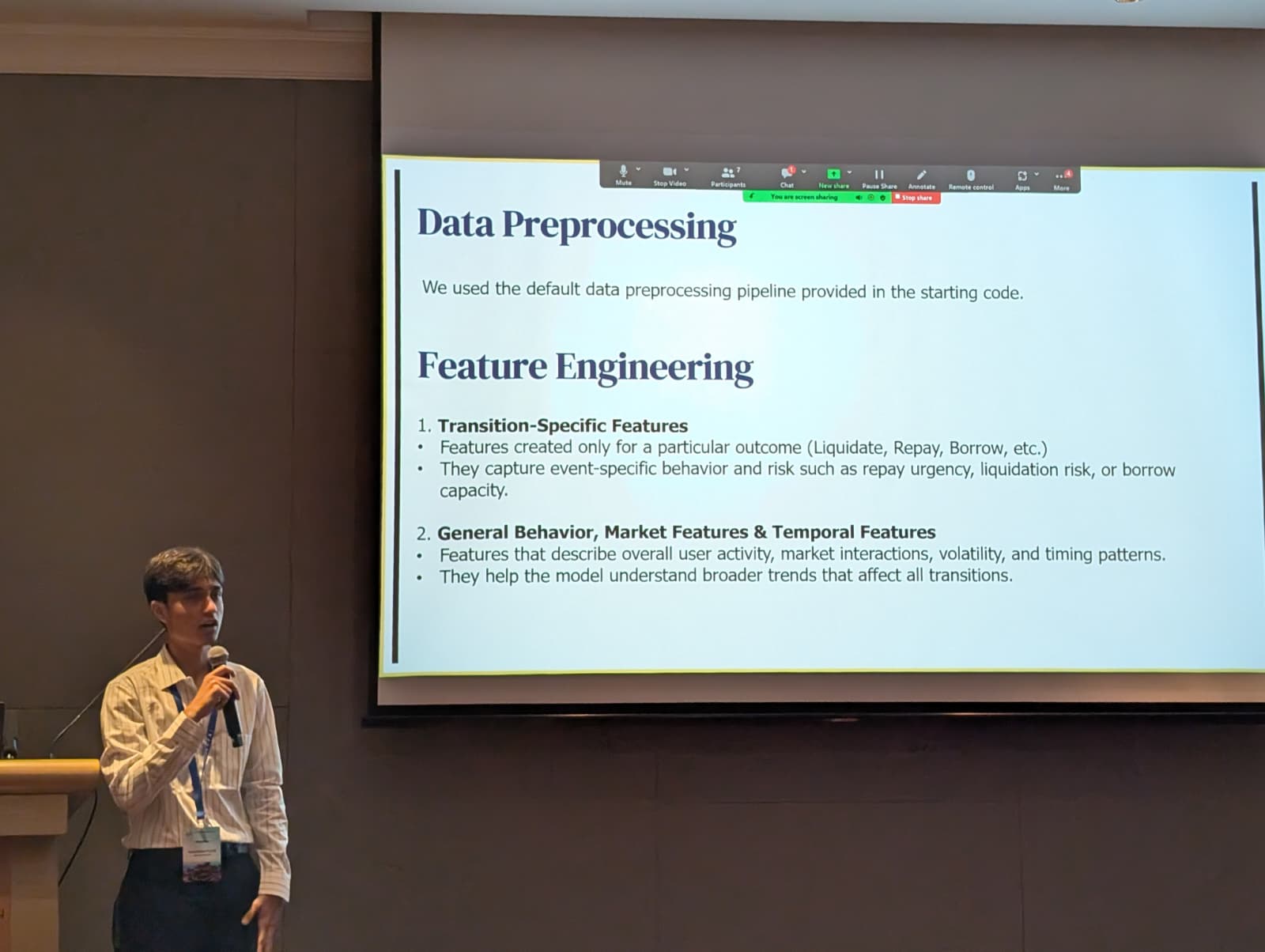

The FinSurvival benchmark consists of 16 time-to-event prediction tasks based on user transactions on the Aave V3 Ethereum protocol. The released benchmark includes over 21.8 million records and 90 engineered features, capturing user behavior, market dynamics, and temporal patterns from March 12, 2022 to July 2, 2024.

Competition Tasks

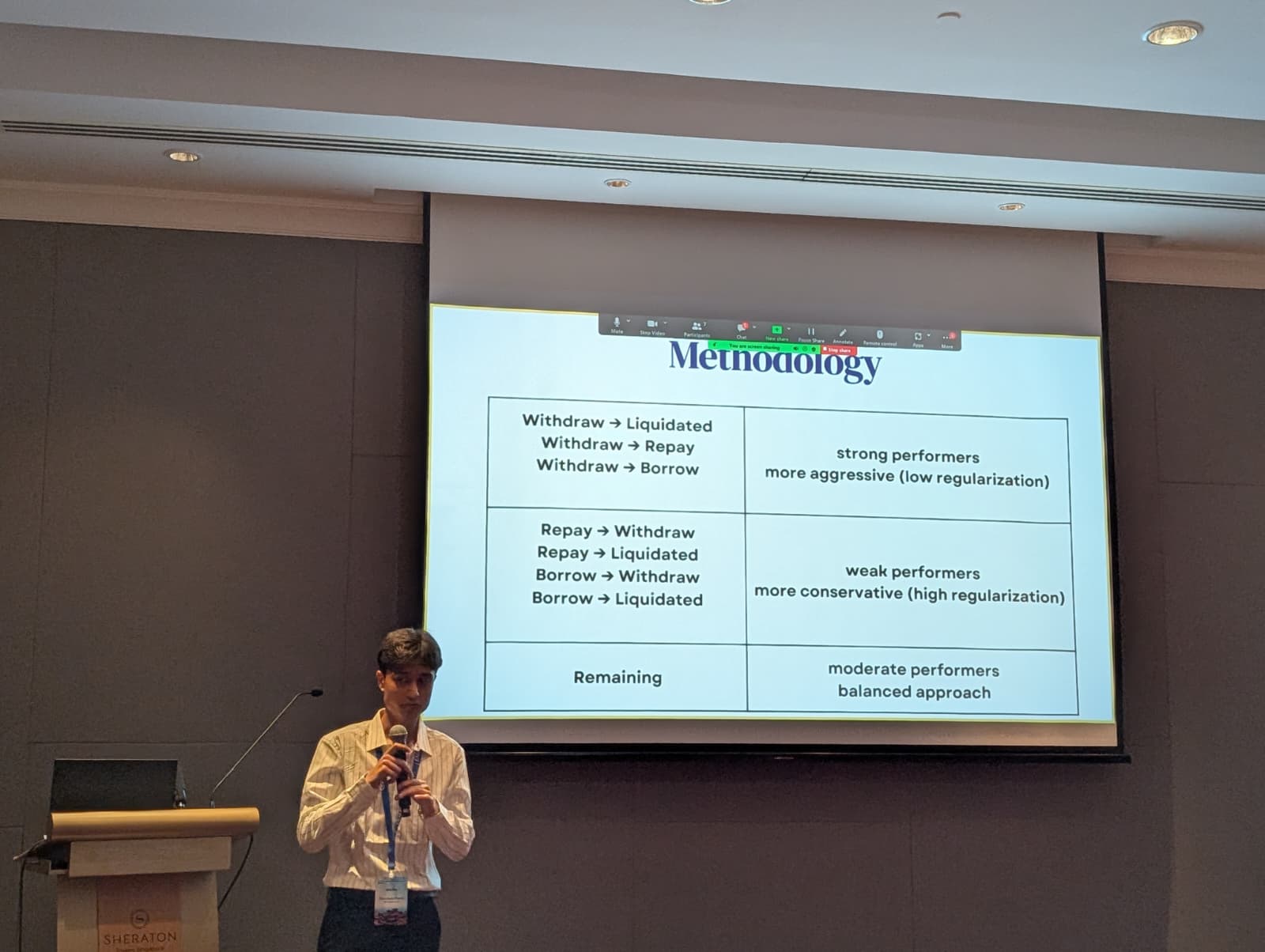

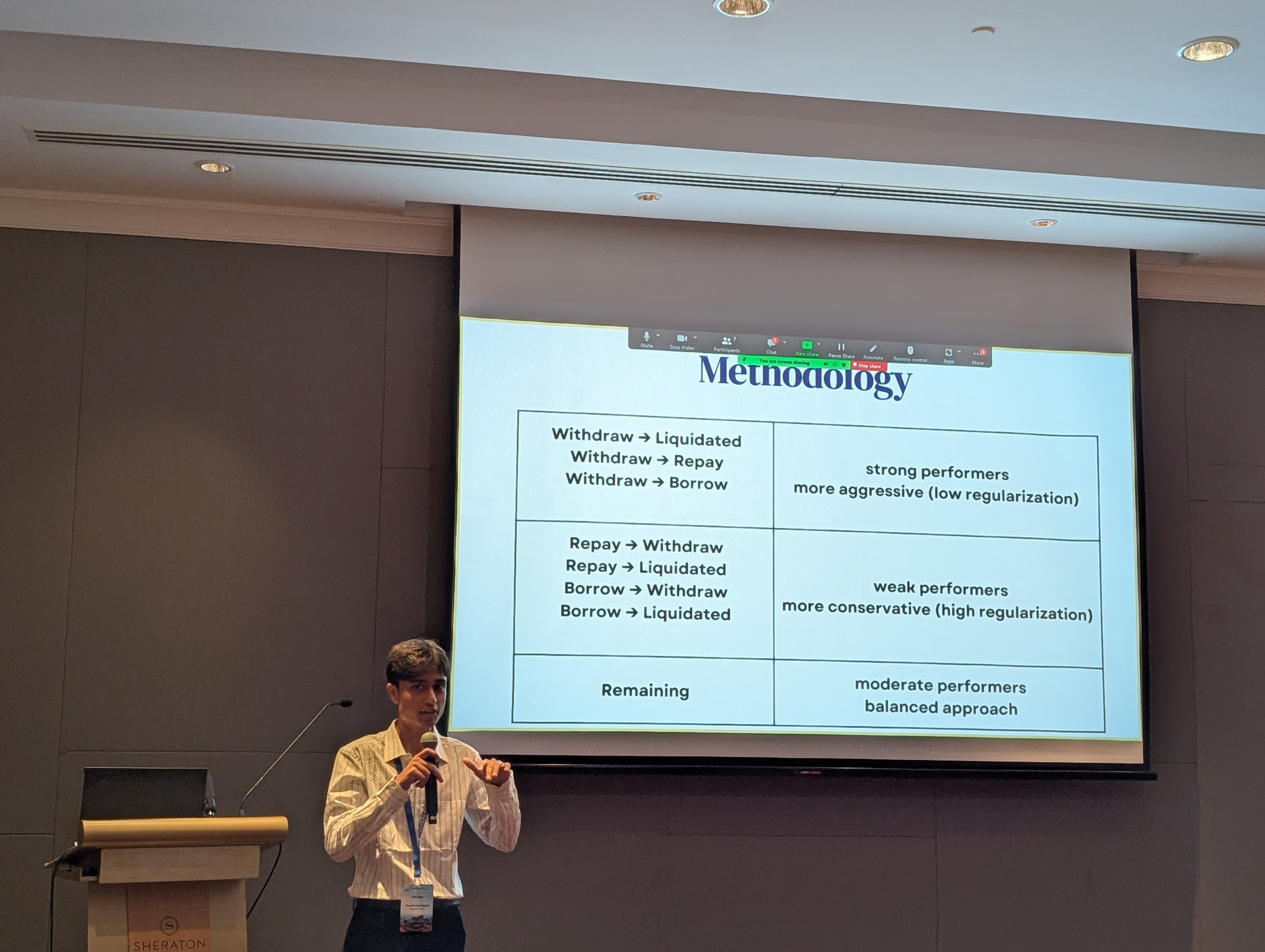

Participants must create models for 16 unique event transitions:

- Borrow → Deposit, Repay, Withdraw, Liquidated

- Deposit → Borrow, Repay, Withdraw, Liquidated

- Repay → Borrow, Deposit, Withdraw, Liquidated

- Withdraw → Borrow, Deposit, Repay, Liquidated

Each dataset record includes the following:

- Index and outcome events: Transaction types initiating and ending a survival interval (e.g.,

borrow→repay). - Time-to-event information: Duration in seconds and censoring indicator.

- 90 features: Including user-specific histories, market-level summaries, and engineered time representations (e.g., cyclic encodings of date/time).

Evaluation Protocol

Evaluation Criteria

The competition is hosted on Codabench, supporting live scoring, submission formatting, and reproducibility.

The competition will include a leaderboard based on an hidden extended dataset, and might also incorporate data from an additional, related but undisclosed DeFi protocol. To ensure a fair and robust evaluation, user addresses are concealed.

Submission Requirements

Your submission must include:

- 16 survival predictions from pre-trained models on the test set (".csv" format) named as "<index_event>_<outcome_event>.csv" (e.g., "Borrow_Repay.csv", "Deposit_Liquidated.csv")

- All packaged in a single ZIP file

FinSurvival Program

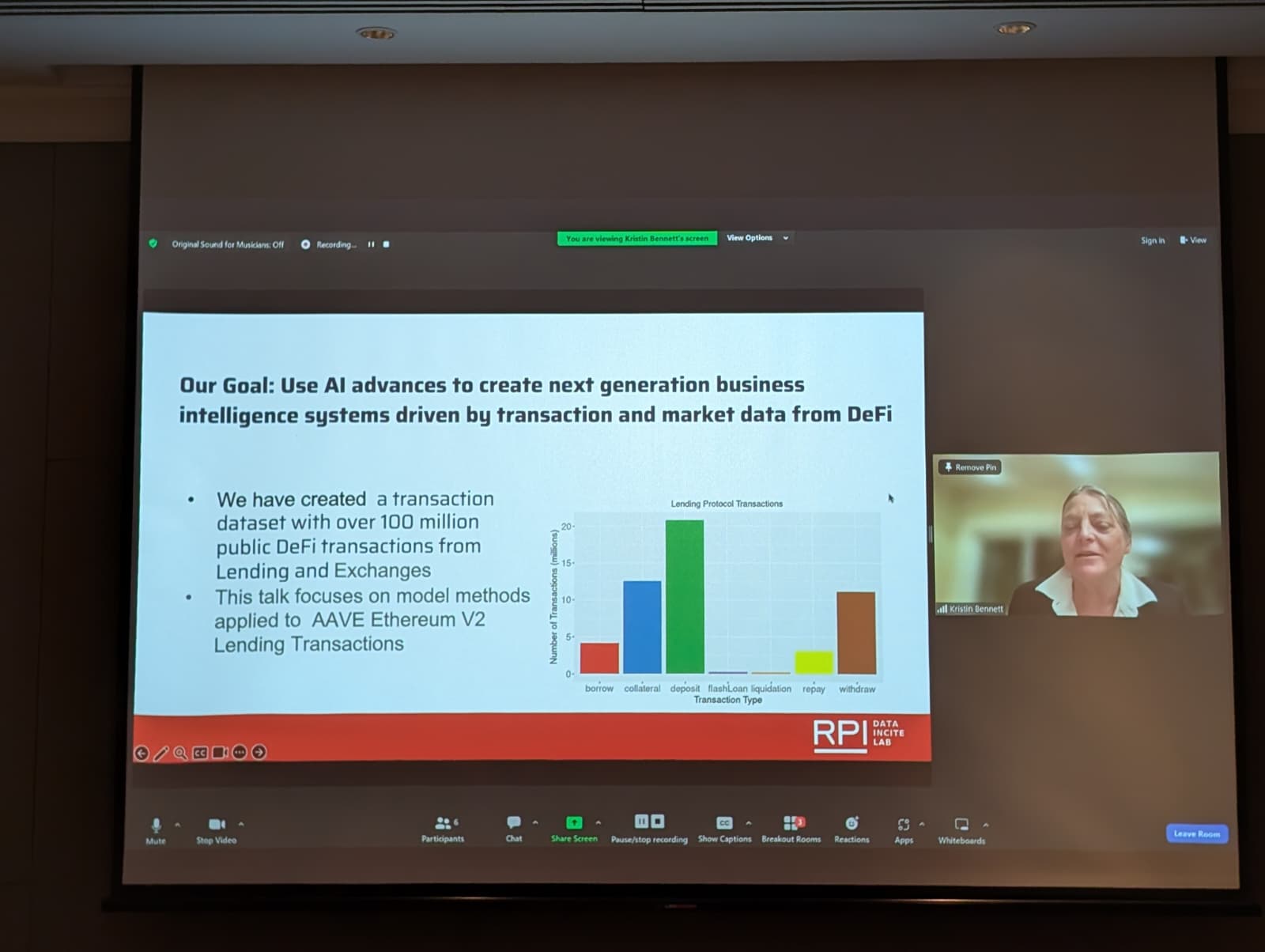

Keynote "Deep Dives in DeFi with AI": Kristin P. Bennett

Abstract

Decentralized finance (DeFi) protocols such as Aave offer a rare opportunity to study large-scale, real-world financial behavior through publicly available transaction-level data. In this talk, we explore how AI analyses of transaction data generated by lending of cryptocurrencies can be used to discover the types of users in DeFi lending and the factors influencing their behaviors. We demonstrate how to use survival modeling to gain insight into usage patterns and risks within the protocol and predict future user transactions. The resulting FinSurvival Benchmark provides a suite of 16 survival modeling tasks for multiple blockchains designed to spur work in this emerging research area. FinSurvival enables the evaluation of AI survival models applicable to centralized and decentralized finance, which is currently hindered by the lack of large public datasets. Our benchmark demonstrates how AI models could assess opportunities and risks in DeFi. In the future, the FinSurvival benchmark pipeline can be used to create new benchmarks by incorporating more DeFi transactions and protocols as the use of cryptocurrency grows..

Bio

Dr. Kristin P. Bennett is a Professor in the Mathematical Sciences, Computer Science, and Industrial Systems Engineering Departments at Rensselaer Polytechnic Institute and the Associate Director of the Institute for Data Exploration and Application and. Dr. Bennett brings over 35 years of research experience in artificial intelligence, machine learning, and their applications to problems in finance, health, science, and industry. Her research specialty is working with people with problems and data and then developing novel machine learning and AI models and methods to solve these problems. With over 130 research publications, she has led many machine learning research science research projects in fintech, health, bioinformatics, cheminformatics, manufacturing, and public health funded by NIH, NSF, DARPA, NRL, research centers, foundations, and industry.

Agenda

-

9:00 – 9:10 AMOpening RemarksOrganizers: Oshani Seneviratne and Fernando Spadea

-

9:10 – 9:45 AMKeynote "Deep Dives in DeFi with AI": Prof. Kristin P. Bennett

-

9:45 – 10:30 AMWinner PresentationsEach team: 10 min talk + 5 min Q&A

Timeline

Data Release and Leaderboard Launch

Development Phase begins: 5 submissions/day, 100 total submissions allowed

Model Testing Cutoff

Final deadline for model submissions and testing. Development phase ends.

Final Phase

2 submissions total, evaluated against holdout test set

Report Submission Deadline

Final deadline for 2-page report submissions along with the source code for reproducibility. Reports must use the ACM Conference Template.

Winners Notified

Top-performing teams are notified and invited to present at ICAIF'25

Presentation at ICAIF'25

Prizes

Compete for exciting prizes and recognition in the FinSurvival Challenge!

Prize Eligibility

To be eligible for prizes, participants must:

- Submit their code and a 2-page report by the specified deadline using the ACM Conference Template

- Follow all competition rules and guidelines

- Provide zipped version of the code with a README.md file for reproducibility

- Meet all eligibility requirements outlined in the Rules

Resources

Video Tutorials

Survival Modeling

An introduction to survival modeling concepts and applications in finance.

Formulating FinSurvival

Learn how the FinSurvival benchmark was formulated and designed.

Benchmarking FinSurvival

Understanding evaluation metrics and benchmarking approaches for survival modeling.

Research Paper

FinSurvival: A Suite of Large Scale Survival Modeling Tasks from Finance

Survival modeling predicts the time until an event occurs and is widely used in risk analysis. We derive a suite of 16 survival modeling tasks from publicly available transaction data generated by lending of cryptocurrencies in Decentralized Finance (DeFi). With over 7.5 million records, FinSurvival provides a suite of realistic financial modeling tasks that will spur future AI survival modeling research.

Organizers

The competition is organized by a multidisciplinary team, with extensive experience in AI for finance, survival modeling, and DeFi.

Ready to Participate?

Submit Your Solution

Join the FinSurvival Challenge and compete with researchers and practitioners worldwide!